Is your payroll data not a part of your Microsoft Dynamics ERP solution? Do you still work with siloed sytems? Are your reports not adequate? If yes is the answer to any of those questions, then PayFocus from Dialog is a perfect solution for you.

Why PayFocus?

PayFocus is an Australian payroll designed for the Australian market and the Australian way of doing business.

It was developed by Dialog in 2005 and has maintained Australian Tax Office accreditation since the inception.

PayFocus is Single touch payroll phase 2 accredited and many customers are now achieving STP-2 approval.

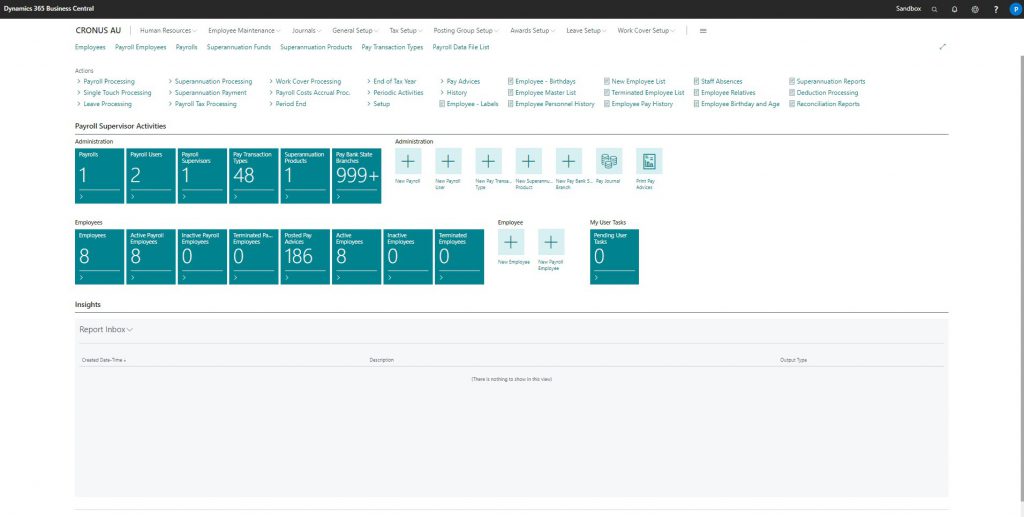

PayFocus is embedded with Microsoft Dynamics Business Central. It looks, feels and works the same as Business Central, making it easy to learn.

PayFocus inherits the power of Microsoft technology and reporting. Being on the cloud PayFocus system is protected by Microsoft Security and data recovery.

PayFocus interfaces with many HR, rostering and award interpretation solution – ensuring you have the all-encompassing solution that best suits you.

Dialog has a dedicated payroll team at your disposal to assist with your payroll specfic needs making Payday easy

PayFocus Key Features:

STP-2 Compliance

PayFocus has been STP-Phase 1 compliant since 2018 and STP-Phase 2 compliant since January 2022. In addition, Dialog’s Payroll meets ATO specifications and supports the upload of data through several major clearing houses.

Leave Management

Dialog’s Payroll supports all statutory leave types (annual, sick, carer’s and long service), including user-defined types such as time in lieu. PayFocus’ leave management includes the ability to:

- Calculate leave based on hours or days worked

- Define maximum entitlements for a period

- Grant leave immediately or establish non-entitlement period

- Establish and define leave loadings

- RDO accruals

- Bulk processing of public holiday transactions for all employees

On-boarding and Terminations

Payfocus simplifies the employee termination process through the use of the Termination Wizard. This automatically calculates the employee’s leave entitlements up to their termination date, correctly allocates pay amounts to the appropriate termination pay components and calculates the applicable tax for each component. It also automatically calculates the pre-and post-July 1983 days of service.

On-boarding starts with HR solution and the data flows in PayFocus.

Reporting

Dialog’s Payroll provides a comprehensive range of payroll reports to meet common reporting needs. In addition, Dynamics 365 Business Central’s powerful inquiry feature enables quick and easy reporting without the need to print a report, as well as drill down to the source transactions.

In addition to the standard payroll reports available, custom reports can be developed to supplement unique reporting requirements. And Power BI reporting is available.

Allowances and Deductions

An unlimited number of allowances and deductions can be defined within PayFocus. These can be reducing balances, dollar or percentage values.

All categories of allowances including before tax, after tax and tax adjustments are supported. Deductions can be based on a fixed value, percentage, rate per hour, unit and once off.

A full history of all employee allowances and deductions is stored in the Employee Ledger.

Superannuation

Dialog’s Payroll supports all Australian superannuation funds. Related transactions with contributions are set up as either Employer or Employee type and any number of contributions can be added to an employee or fund.

- Define unlimited superannuation funds for each employee

- Ensures legislative compliance to calculate superannuation for casual employees

- Define superannuation contributions as a fixed amount or a percentage of earnings

- Drill down to individual superannuation transactions on the employee record

- Generate superannuation fund payments

Other

Back Pays – PayFocus supports automated back pay calculations. Back pays can be processed quickly using either a percentage or dollar value applied to previously paid amounts. Customised messages can be added to the employee’s pay advice. A global back pay can be applied across a group of associated employees.

Security – The Payroll User Security feature governs which particular user (or Branch/Division) has access to specific payrolls and whether they have “view only” access or the ability to edit records. Business Central’s Audit Trail feature provides additional security through logging all changes to records recording the user id, time and date of the change.

Timesheets – PayFocus supports timesheets for both payroll and job costing. PayFocus can integrate with external timesheet systems and it is very simple to use Microsoft PowerApps to generate timesheets that are specific to unique requirements.

Tempted to know why 1000’s of people are happily paid with Payfocus then download your free version , view a brief video of PayFocus or contact us below.

One customer said: “I cannot believe how easy it is use PayFocus. For our operators, it looks and feels exactly the same as the ERP solution. For Finance, PayFocus embedded in the ERP, uses all the strength and power of the ERP for reporting and analysis. We do not have to send our data somewhere else to view it. As it is part of the Microsoft solution, it uses all the security that is inherent with a Microsoft Best of Breed application. We highly recommend PayFocus.